The Mortgage Market Now

Aug 13, 2025

Navigating the 2025 Mortgage Landscape: Strategic Insights for Executives

Hey there, mortgage industry leaders! It’s Matt Slonaker, and I’m diving into the latest trends from the July 2025 Optimal Blue Market Advantage report, blending them with broader market insights to give you actionable strategies. As we navigate a dynamic market, affordability challenges, shifting product mixes, and fintech advancements are reshaping how we operate. Here’s my take on what mortgage executives need to focus on to stay ahead in 2025.

The Big Picture: Market Shifts Demand Agility

Let’s start with the numbers. Total rate locks dropped 3% month-over-month in July, driven by a 5% dip in purchase activity—a clear signal that affordability remains a hurdle. Meanwhile, refinance share climbed to 20%, with cash-out and rate-term refis up 5% and 7%, respectively. This tells me borrowers with post-2022 loans are seizing opportunities to lower payments, and we should be ready to capture this demand.

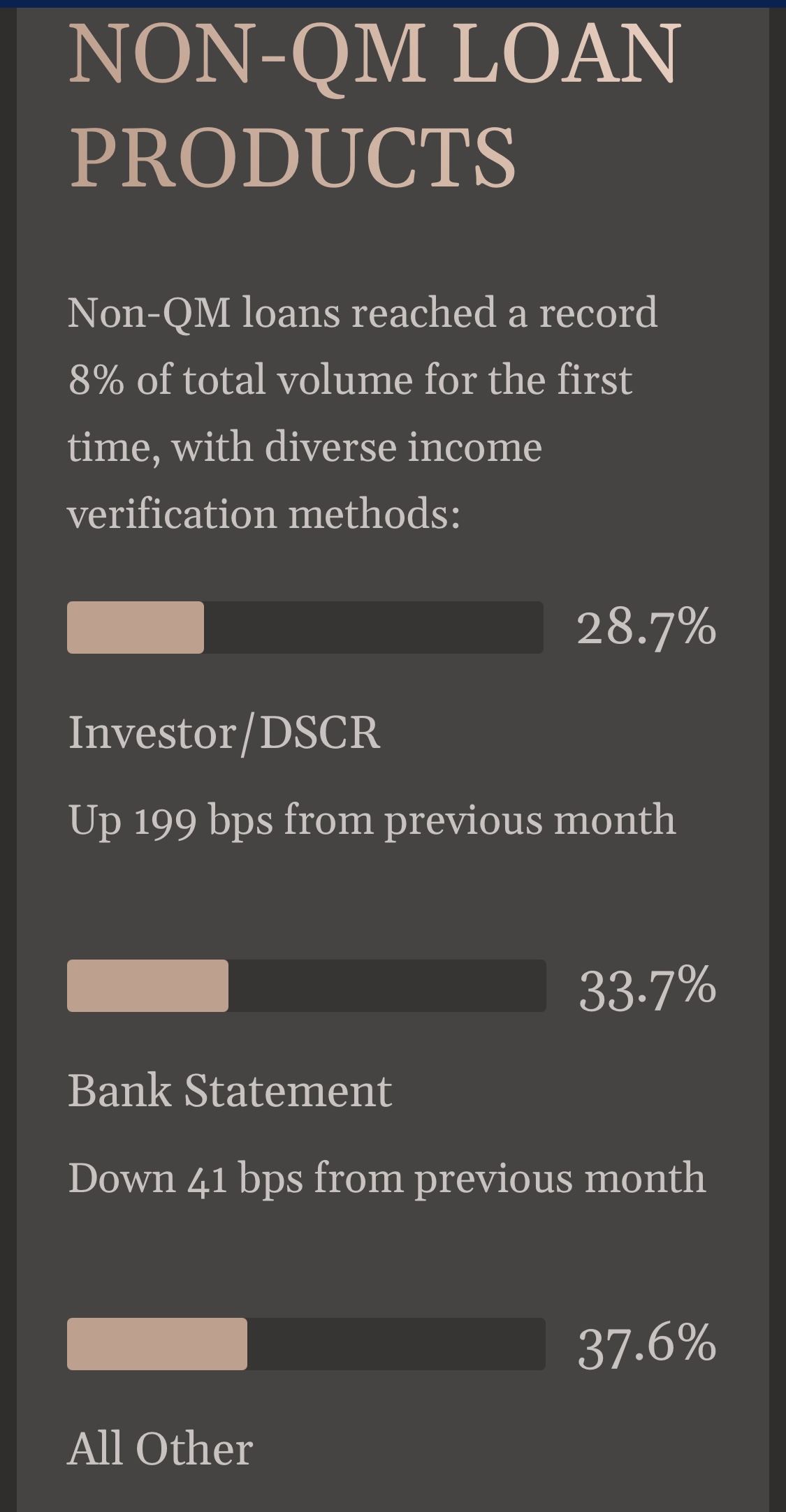

Non-QM loans hit a record 8% of volume, with bank statement loans (34%) and investor/DSCR (29%) leading the charge. Adjustable-rate mortgages (ARMs) also gained traction, rising to 9.52% of volume. On the secondary market, agency mortgage-backed securities (MBS) executions jumped to 37%, while cash window sales fell 200 basis points to 26%. These shifts scream opportunity—but only if we adapt fast.

Here’s how we can turn these trends into wins for our teams and borrowers.

10 Strategies to Thrive in 2025

- Lean into Refinances with Targeted Campaigns

Refinances are gaining steam, and borrowers with recent loans are prime targets. I’m pushing my team to roll out hyper-focused marketing—think personalized emails and social ads—aimed at these homeowners. Let’s allocate more loan officers to refi pipelines and streamline processes to handle the uptick. With refi pull-through rates slipping to 61.1% (down 142 bps), we need to tighten up our conversion game. - Double Down on Non-QM Growth

Non-QM’s record 8% share is a wake-up call. Products like non-agency prime, HELOCs, and bridge loans are trending, signaling a market shift toward non-traditional borrowers. I’m investing in specialized underwriting training and forging partnerships with lenders who excel in investor/DSCR and bank statement loans. This isn’t just diversification—it’s a chance to grab market share in a growing segment. - Counter Purchase Volume Declines

The 5% drop in purchase locks hurts, but I’m not sitting idle. Partnering with real estate agents and builders to offer incentives like rate buydowns or closing cost assistance can keep deals moving. Let’s get creative with first-time homebuyers (FTHBs), who make up 58% of agency purchase lending, by tailoring products to their needs and leveraging loan-level pricing adjustment relief. - Push ARMs as a Smart Alternative

With ARMs at 9.52% and the yield curve flattening, it’s time to educate borrowers on their benefits. I’m training my originators to position ARMs as a hedge against rate volatility, especially for those planning shorter-term ownership. Let’s make sure our teams can explain how ARMs can save money upfront in this 6.72% conforming rate environment. - Focus on High-Growth Property Types

Planned unit developments (PUDs) rose 0.85% to 28.5% of production, even as single-family homes slipped. I’m redirecting our focus to PUDs and multi-unit projects, especially in urban markets. Let’s develop products tailored to these communities and lean into new construction opportunities, despite the 4% year-over-year decline in that segment. - Optimize Secondary Market Plays

The shift to MBS executions (37%) over cash windows (26%) is a chance to boost profitability. I’m doubling down on advanced hedging tools through platforms like CompassEdge to manage rate risk. For larger lenders, this is our moment to scale securitization and capture market share. Let’s ensure our teams are equipped with real-time analytics to make smarter execution decisions. - Fix Refi Pull-Through Challenges

That 61.1% refi pull-through rate is a red flag. I’m implementing AI-driven pre-qualification tools and offering lock extensions to keep deals on track. Streamlining applications with digital workflows can cut fallout and lower origination costs, letting us pass savings to borrowers and stay competitive. - Target Hot Regional Markets

The data shows New York (5.2% of volume, $587K average loan) and Los Angeles (31% refi share) as hotspots. I’m customizing rates and products for high-cost MSAs, especially where loan-to-value ratios are higher. Let’s deploy local teams to these regions and tailor offerings to match their unique economic trends. - Strengthen Risk Management

Slight FICO score declines (conforming to 756, FHA to 675) and stable debt-to-income ratios signal we need tighter risk models. I’m rolling out credit repair services for FTHBs and enhancing analytics to predict defaults, especially in government loans where delinquencies are creeping up. Staying proactive here keeps our portfolios healthy. - Embrace Fintech for ROI

The report quotes Julian Hebron saying 2025 marks the “ROI phase of the FinTech era,” and I couldn’t agree more. AI is transforming how we hedge MSRs (down 3 bps to 1.19) and manage pipelines. I’m investing in self-service portals, mobile apps, and AI-driven personalization to boost customer satisfaction (currently a dismal 596) and cut costs. Let’s lead the charge in tech adoption.

A Word on Servicing: Stay Vigilant

For those of us overseeing servicing, there are a few critical points to watch. Prepayment risks are rising with refinance activity, so monitor those post-2022 loans closely—FTHBs may be slower to prepay but carry higher default risks. MSR volatility demands sophisticated hedging, especially with rates projected to dip to 5.9%-6.3% by year-end. Regulatory scrutiny from the CFPB and state agencies is intensifying, so ensure your compliance systems are airtight. Finally, don’t sleep on customer experience—poor communication and escrow issues are dragging satisfaction down. Digital tools and clear messaging are non-negotiable.

Let’s Seize the Moment

The 2025 mortgage market is a mix of challenges and opportunities. Affordability constraints and declining purchase volume test our resilience, but rising refis, non-QM growth, and fintech advancements offer paths to profitability. As executives, our job is to act decisively—whether it’s targeting high-growth regions, optimizing secondary market strategies, or embracing AI to enhance efficiency and borrower experience. Let’s lean into these trends, adapt our playbooks, and lead our teams to success.

What’s your take on these shifts? Drop me a line or join the conversation on the Market Advantage podcast. Let’s keep pushing the industry forward together.

Matt Slonaker

August 13, 2025

Note: Data sourced from the Optimal Blue Market Advantage Report, July 2025, and supplemented with industry insights from MBA web and X sources.