MBA Annual Reflection

Oct 22, 2025

Reflections from MBA Annual 2025: Navigating the Mortgage Landscape Ahead

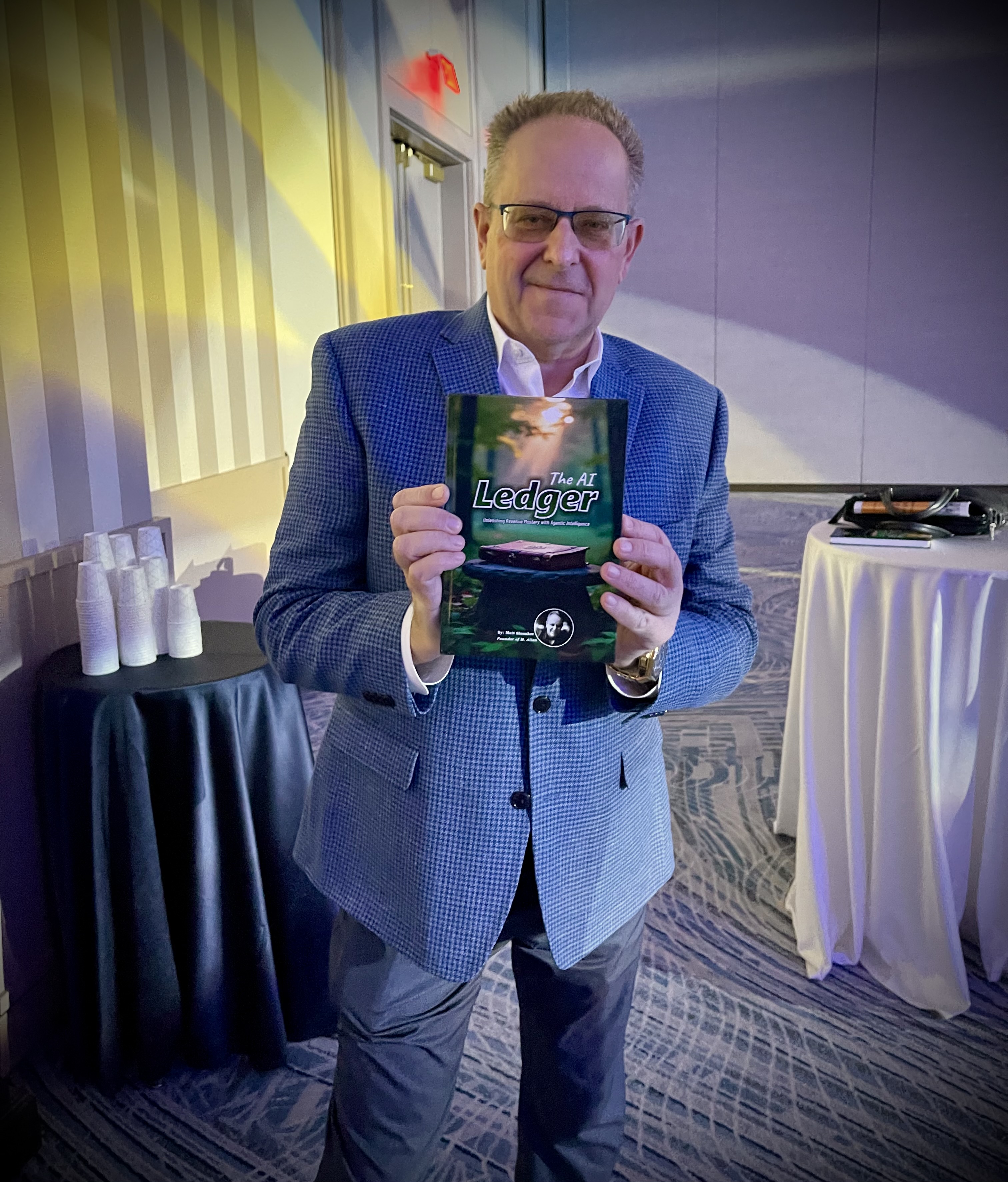

Hey everyone, Matt Slonaker here. As someone who’s been knee-deep in the mortgage world for years, attending the Mortgage Bankers Association’s Annual Convention & Expo is always a highlight. This year’s event in Las Vegas, wrapping up just this week, brought together the best minds in residential real estate finance to tackle the evolving market, regulatory shifts, and tech disruptions. With sessions buzzing about everything from AI to affordability, it was clear we’re at a pivotal moment. Drawing from the key discussions, forecasts, and networking vibes, I’ve distilled ten core themes that stood out. For each, I’ll share the main insights gleaned from the conference and toss in my quick take as a practitioner who’s seen cycles come and go.

1. AI and Technology Innovation

The conference hammered home AI’s role in transforming operations, with panels emphasizing its potential in underwriting, compliance, lead generation, and servicing. Executives like Brian Woodring from Newrez called it “80% hype, 20% reality,” but stressed the real promise in automation for better efficiency and borrower experiences. 58 Sessions showcased demos on AI for faster closings and reducing loan abandonment, while warnings abounded about implementation challenges like compliance and ROI.

My POV: AI isn’t just buzz—it’s a game-changer for scaling in a tight market, but we can’t chase shiny objects. Focus on tools that solve real pain points, like streamlining origination, or risk wasting resources in an industry already squeezed on margins.

2. Industry Consolidation and M&A Activity

M&A was the “elephant in the room,” with leaders discussing how deals like Guild Mortgage’s recent acquisition by Bayview Asset Management provide capital for growth amid market pressures. 58 Consolidation was framed as a natural evolution, enabling larger players to deploy tech and achieve scalability, especially in retail channels.

My POV: In a fragmented market, consolidation builds resilience, but it’s not for everyone. Smaller lenders should eye partnerships strategically—I’ve seen M&A unlock efficiencies, but cultural fits matter as much as balance sheets to avoid post-deal headaches.

3. Affordable Housing Initiatives

MBA Chair Christine Chandler spotlighted this as a top priority, pushing for lower credit reporting costs, VantageScore adoption by GSEs, reduced regulatory burdens, and more private capital to compete with government programs. 60 Insights included breaking D.C. barriers to make financing cheaper and more accessible, building on past wins.

My POV: Affordable housing isn’t charity—it’s economic fuel. Easing regs and innovating credit models could unlock inventory, but we need bipartisan buy-in. From my lens, this is where lenders can lead by partnering with communities, turning policy wins into real homeownership gains.

4. Regulatory Compliance and Enforcement

Breakout sessions dove into shifting enforcement priorities as the CFPB’s influence wanes, with lenders navigating new landscapes in servicing and compliance. 51 Discussions on automation and data-driven tools highlighted how tech can strengthen compliance amid market pressures.

My POV: Regs are tightening, but smart automation turns compliance from a cost center to a competitive edge. I’ve advised teams to proactively audit processes—better to invest now than face fines later, especially with evolving fair lending scrutiny.

5. Economic Outlook and Market Forecasts

MBA’s 2026 outlook projected an 8% rise in single-family originations to $2.2 trillion, driven by improving affordability and lower rates. 31 Sessions forecasted momentum in residential and commercial sectors, with rates potentially dipping to support recovery.

My POV: Optimism is warranted with rates easing, but don’t bet the farm—volatility lingers from inflation and deficits. In my experience, prepping for 5-6% rates means diversifying products; this could spark refis, but purchase markets will drive sustainable growth.

6. Next Generation Leadership Development

Chandler’s speech called for cultivating future leaders amid a generational shift, promoting MBA’s Future Leaders programs, mPact network, and education offerings to build talent benches. 60 Themes centered on training for roles in a changing industry.

My POV: The boomer exodus is real, and we’re short on ready talent. Mentoring through programs like these has paid off in my teams—invest in upskilling now, or watch competitors poach your best. It’s about legacy: build leaders who innovate, not just execute.

7. Advocacy and Policy Influence

Advocacy was Chandler’s biggest push, urging more member involvement via MORPAC, Mortgage Action Alliance, and D.C. conferences, crediting it for wins like the trigger leads ban. 60 Insights stressed unity across residential and commercial for broader impact.

My POV: Washington’s decisions ripple to our desks—I’ve seen advocacy flip regs in our favor. Get involved; it’s not optional in this climate. Collective voices amplify, turning industry challenges into policy shifts that protect borrowers and lenders alike.

8. Automation in Mortgage Processes

From automated QC and processing tools to AI considerations, sessions explored cost-cutting via tech in origination and servicing. 21 Highlights included Mortgage-as-a-Service models and tools for compliance and secondary marketing.

My POV: Automation slashes overhead in a high-cost era, but integration is key—I’ve streamlined ops with these, boosting throughput 20-30%. Prioritize user-friendly tech; it frees teams for high-touch borrower interactions, where humans still win.

9. Diversity and Women in Leadership

mPower sessions focused on women driving change, addressing funding gaps, board access, and infrastructure for growth. 23 Insights emphasized bold leadership and WBENC-certified firms like ProxyPics contributing to inclusive progress.

My POV: Diversity isn’t a checkbox—it’s innovation fuel. Events like mPower highlight untapped talent; in my view, inclusive teams outperform, especially in client-facing roles. Push for equity to build a resilient industry that mirrors America’s demographics.

10. Credit and Risk Management

Chatter around credit news, agency updates, and tools like bank statements and DSCR loans underscored evolving risk strategies. 25 Sessions tied this to broader compliance and market forecasts, with VantageScore adoption as a win for competition.

My POV: Credit models are evolving fast—embrace alternatives to tri-merge for fairer access. Risk management is my wheelhouse; tightening underwriting now prevents future defaults, but flexibility wins deals. Balance caution with opportunity to thrive in 2026’s projected uptick.

Wrapping up, MBA Annual 2025 left me energized about our industry’s adaptability. From AI’s promise to advocacy’s power, we’re poised for rebound if we collaborate and innovate. As always, let’s keep the conversation going—drop your thoughts below. Until next year, stay ahead of the curve.

-Matt Slonaker