The Joy (and Edge) of Sports Card Collecting vs. Stock Investing

There’s a particular kind of quiet happiness that comes from flipping through a stack of well-loved cards—paper, ink, a player’s story pressed into cardboard. It’s tactile and human in a way a brokerage app will never be. I love that. But I also love the puzzle: pricing, scarcity, timing, risk. Sports cards live at the intersection of nostalgia and strategy, and that’s where I’ve found a sweet spot that echoes (and sometimes outperforms) the way I think about equities.

Below is how I frame the hobby through an investor’s lens—what feels the same, what’s different, and why this mix keeps me engaged.

Why Cards Feel Different—And Better—in Some Ways

- Tangible asset, emotional dividend

Stocks give you exposure to a business; cards give you the player, the moment, the memory. Cards pay two “dividends”: potential financial return and genuine joy. Pulling a 2018 Prizm Luka rookie in a clean PSA 10 or finding a raw, well-centered 2000 Bowman Chrome Brady at a local show—there’s a spark there you don’t get when a ticker jumps 3%.

- Inefficiencies you can see and touch

Public markets are ruthlessly efficient. Cards? Not always. Local shows, raw/ungraded inventory, under-followed parallels, mispriced lots, and inconsistent auction timing create real edges for prepared buyers. That’s hard to replicate in large-cap equities.

- Story-driven catalysts

Earnings beats move stocks; a playoff run, MVP season, call-up, or Hall of Fame induction can re-rate a player’s card market overnight. The narratives are faster, messier, and more fun.

How Cards Map to Equities

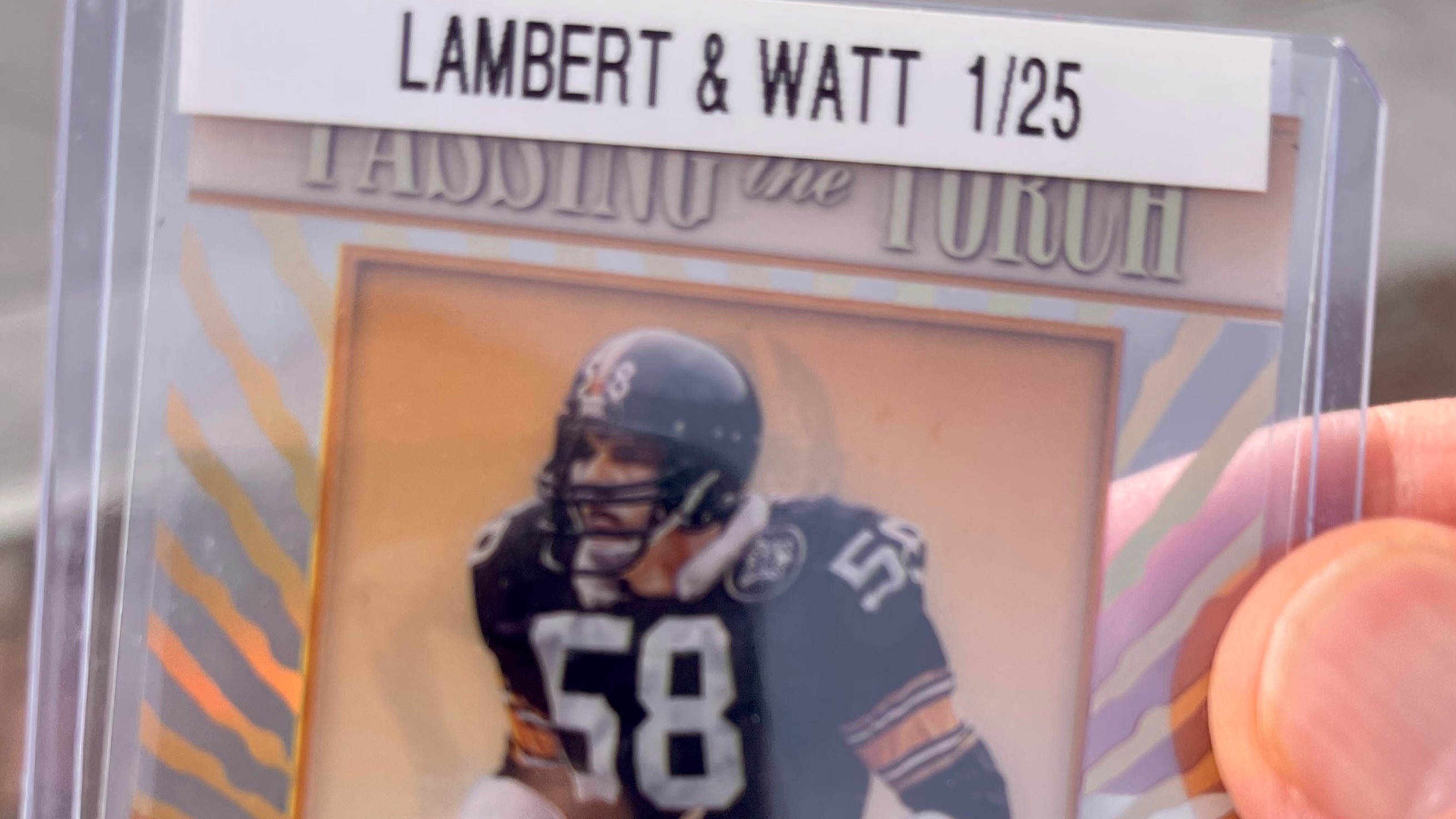

- Supply dynamics

Cards: print runs, short prints, serial numbering, and population reports (PSA/BGS/SGC) are your “shares outstanding.” A low pop PSA 10 is like a limited float with high demand. Reprints, new sets, and grading trends affect the supply curve.

Stocks: authorized shares, float, dilution, buybacks. Cleaner, more transparent—but less exploitable.

- Grading vs. credit ratings

PSA/BGS/SGC grades are quality signals like credit ratings or auditor opinions. A bump from 9 to 10 can be a complete re-rating of value. Eye appeal and subgrades add nuance akin to qualitative analyst notes.

- Liquidity and spreads

Cards: auction cycles, buyer’s premium, shipping/insurance, platform fees—plus wider bid/ask spreads on rare items. Liquidity can vanish when sentiment turns or a season ends.

Stocks: tight spreads, deep liquidity (for most names), instant execution.

- Pricing and comps

Cards: “fair value” is a mosaic—recent comps, condition, pop, centering, timing, and venue. Pricing feels more art than science.

Stocks: price targets, DCFs, multiples, comparable companies. More models, fewer surprises—until there are surprises.

- Risk factors

Cards: injury, performance dips, role changes, prospect busts, overproduction, trimming/counterfeits, grading policy shifts, hobby cycles.

Stocks: macro shocks, regulation, competition, execution risk, fraud.

- Time horizons

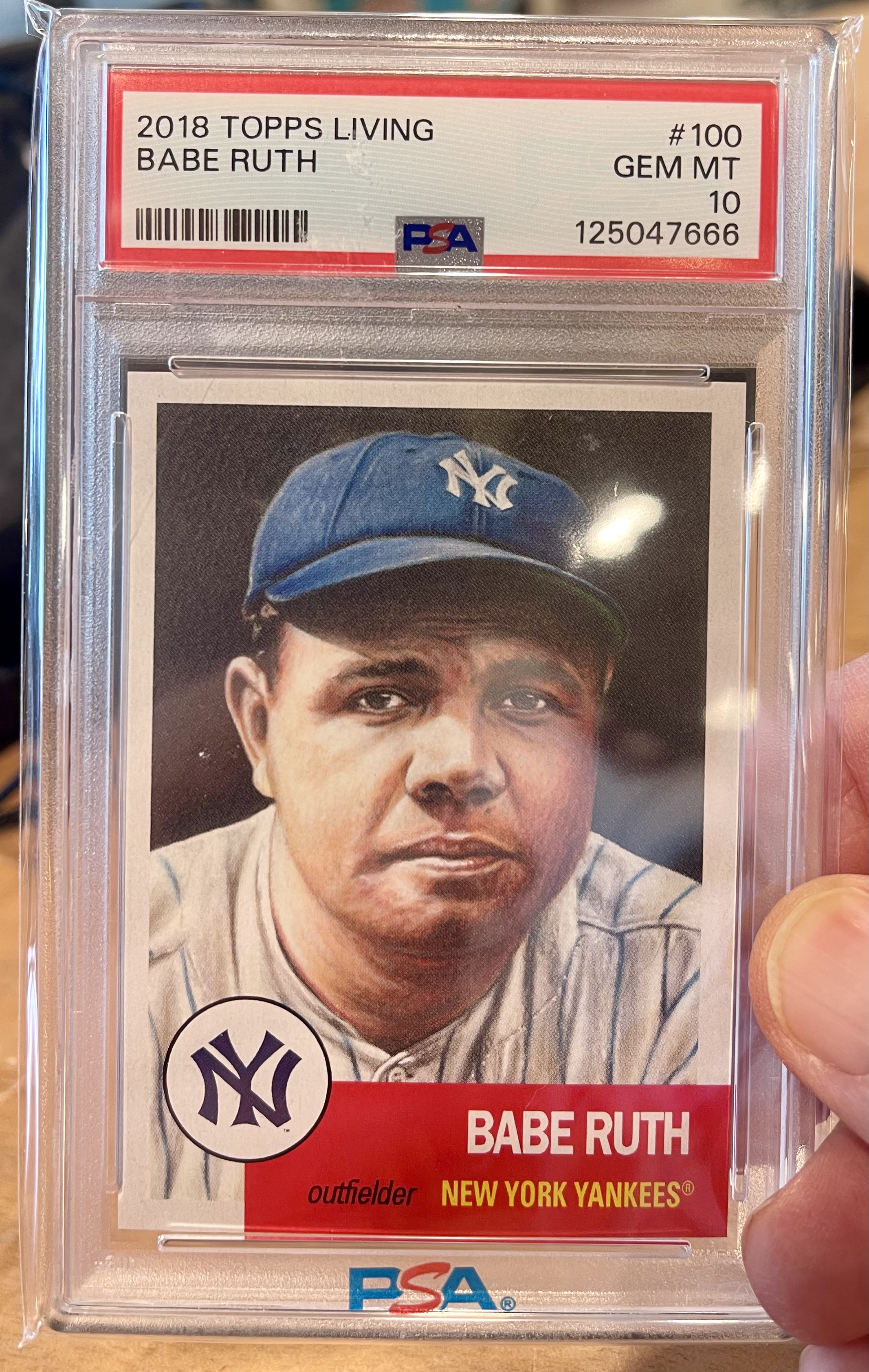

Cards: swing trades (preseason hype, playoff windows), mid-term (award races), long-term “GOATs” and iconic sets (1952 Topps Mantle, 1986 Fleer Jordan).

Stocks: short-term momentum, mid-term catalysts (product launches), long-term compounders.

My Card Portfolio Framework

I think in buckets—just like asset allocation:

1. Blue-Chip Legends (anchor)

- Established icons with durable demand: Michael Jordan, Tom Brady, Mickey Mantle, LeBron James, Mike Trout.

- Flagship rookies, clean grades, low-to-mid pop. This is my “quality compounder” bucket.

- Allocation: 50–70% depending on risk appetite.

2. Prime-Time Performers (growth)

- Active stars with strong resumes and ongoing catalysts: Luka, Mahomes, Shohei Ohtani, Giannis.

- Focus on flagship rookies (Topps/Prizm/Bowman), numbered parallels, on-card autos.

- Allocation: 20–40%.

3. Prospects and Microcaps (speculative)

- High-variance rookies and call-ups; modern inserts with thinner liquidity.

- Smaller position sizes, strict risk limits.

- Allocation: 5–15%.

Entry and Exit Playbook

- Buy liquid flagships first

For modern: Topps (baseball), Prizm/Select/Optic (basketball/football), Bowman Chrome for prospects. Liquidity helps if the thesis changes.

- Lean on seasonality

Offseason discounts are real. Consider buying before likely catalysts (training camps, playoffs, awards) and selling into strength instead of chasing.

- Anchor with data

Check population reports, recent comps, centering/surface, and venue (eBay vs. premier auctions can differ). Treat a PSA 10 with pop 500 differently than pop 5,000.

- Grade smart

On high-end cards, graded is often safer. On mid-tier modern, evaluate raw carefully—centering, corners, surface—then decide whether the grading upside covers fees and risk.

- Set targets

Define entry price, thesis catalyst, expected holding period, and a realistic exit range. If the catalyst fails, move on. Protect capital.

Risk Controls I Respect

- Position sizing

Cap exposure per player, set, and grade. No single player makes or breaks the portfolio.

- Authenticity and condition

Stick to trusted marketplaces for high-end; inspect edges and surface under light; watch for trimming or recoloring. Verify slabs.

- Fee awareness

Bake in buyer’s premiums, shipping/insurance, and grading fees. Your real cost basis matters.

- Documentation

Keep a simple ledger: purchase date, source, grade, pop, comps, thesis, exit.

- Tax and custody

Cards are assets—understand your local tax treatment and consider storage/insurance for higher-value holdings. When in doubt, talk to a qualified tax professional.

Quick Side-by-Side

- What I can touch

Cards: you physically hold your investment; aesthetics and story matter.

Stocks: digital exposure; business fundamentals matter.

- Inefficiency potential

Cards: higher—edges in show floors, raw finds, and timing.

Stocks: lower—especially in large caps.

- Liquidity

Cards: variable, venue-dependent, wider spreads.

Stocks: generally high, instant execution.

- Catalysts

Cards: performance, awards, narratives, grading changes.

Stocks: earnings, guidance, macro data, regulation.

- Valuation tools

Cards: comps, pop, eye appeal, set prestige.

Stocks: multiples, DCFs, comps, growth rates.

The Joy Factor

Cards make me slow down. They’re history you can hold—rookies that felt like lottery tickets, legends whose careers became cultural landmarks. And then there’s the community: show chatter, trade tables, the collective thrill of a big auction night. The upside isn’t only measured in $—it’s measured in smiles, stories, and moments that stick.

But the best part is when the joy and the discipline meet. Do the work. Know your sets and players. Respect liquidity and risk. Let inefficiency be your edge. And still smile when you slide a grail into a fresh sleeve.

That’s why I keep collecting—and why I keep investing. It’s not just cardboard; it’s a living portfolio with a heartbeat.

Top 10 Vintage Sports Cards to Hunt ($100-$500 Range)

Based on current market trends as of December 2025, here are 10 standout vintage-era (pre-2000, focusing on 1980s-1990s) cards across baseball, hockey, football, and basketball. These are primarily PSA 8-9 graded rookies or key cards from Hall of Famers with enduring legacy and steady demand. Values draw from recent eBay sold listings and price guides like Beckett and SportsCardsPro—target raw or mid-grade versions at shows for deals under $500, with grading potential for flips. Balanced with 3 each for baseball and basketball, 2 for hockey and football.

Baseball (Focus: Iconic 1980s rookies from the junk wax era’s hidden gems)

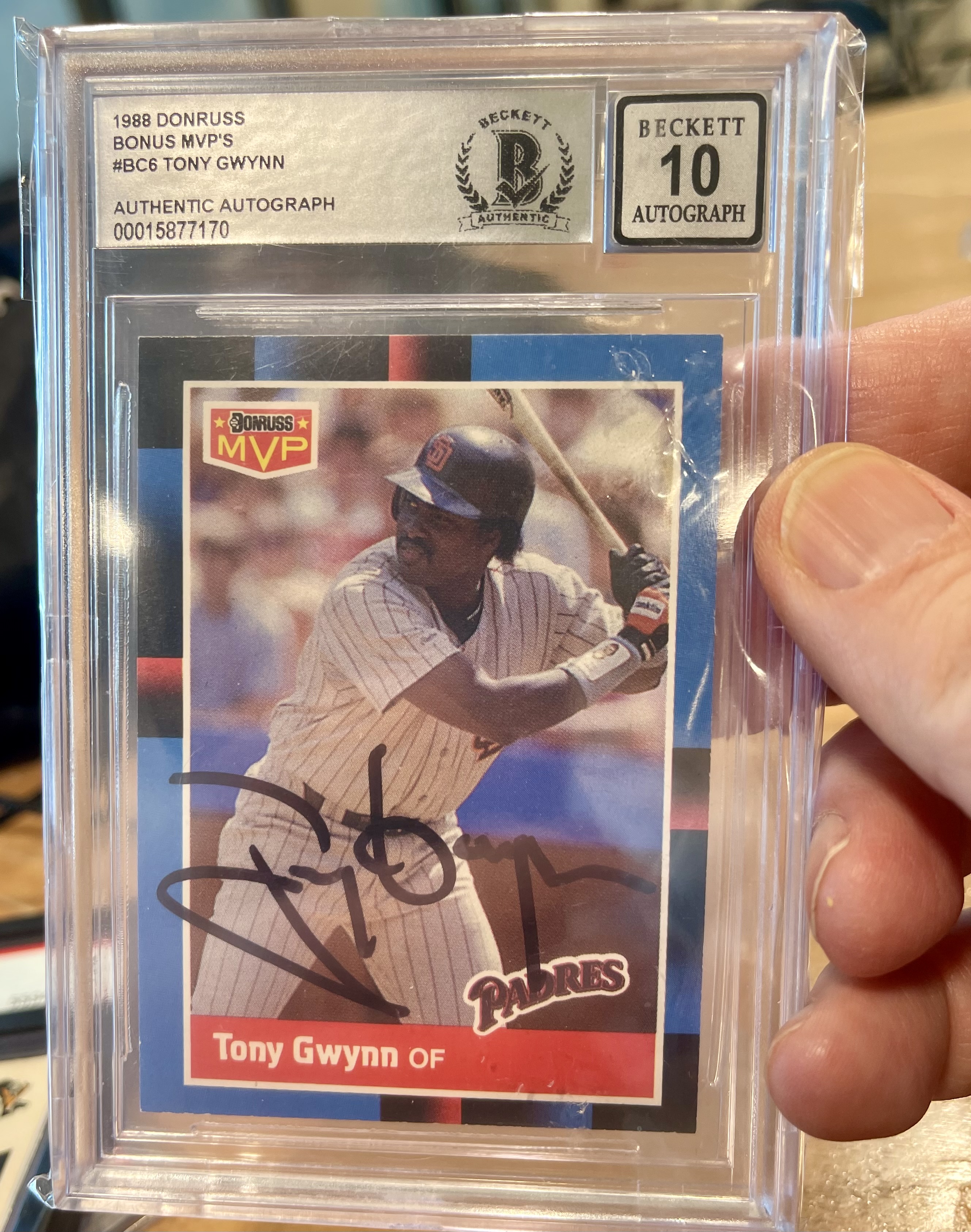

- 1983 Topps Tony Gwynn Rookie #482 PSA 8

Value: $150-$250

Why it’s a buy: Gwynn’s .338 career average and 8 batting titles make this Padres legend’s rookie a cornerstone of 1980s collecting. Low pop in high grades (~1,200 PSA 8s) and his clean HOF image drive consistent value—ideal for hitters collectors.

- 1987 Topps Mark McGwire Rookie #366 PSA 8

Value: $200-$300

Why it’s a buy: Big Mac’s 583 HRs and ‘98 home run chase nostalgia keep this A’s slugger’s card hot despite controversies. Affordable entry from the overprinted era, with upside as a ’90s power icon.

- 1989 Upper Deck Ken Griffey Jr. Rookie #1 PSA 8

Value: $250-$400

Why it’s a buy: The Kid’s 630 HRs and defensive wizardry launched Upper Deck’s premium era. This flagship rookie (~2,000 PSA 8s) remains a gateway vintage card, trading strong on Mariners loyalty and clean legacy.

Hockey (Focus: Gretzky-era stars with scarcer mid-1980s prints)

- 1984 O-Pee-Chee Wayne Gretzky #132 PSA 8

Value: $300-$450

Why it’s a buy: The Great One’s dominance (894 goals) elevates this Oilers card from his peak years. Scarcer than OPC rookies, with low PSA 8 pop (~800), it’s a blue-chip hold for Gretzky completists.

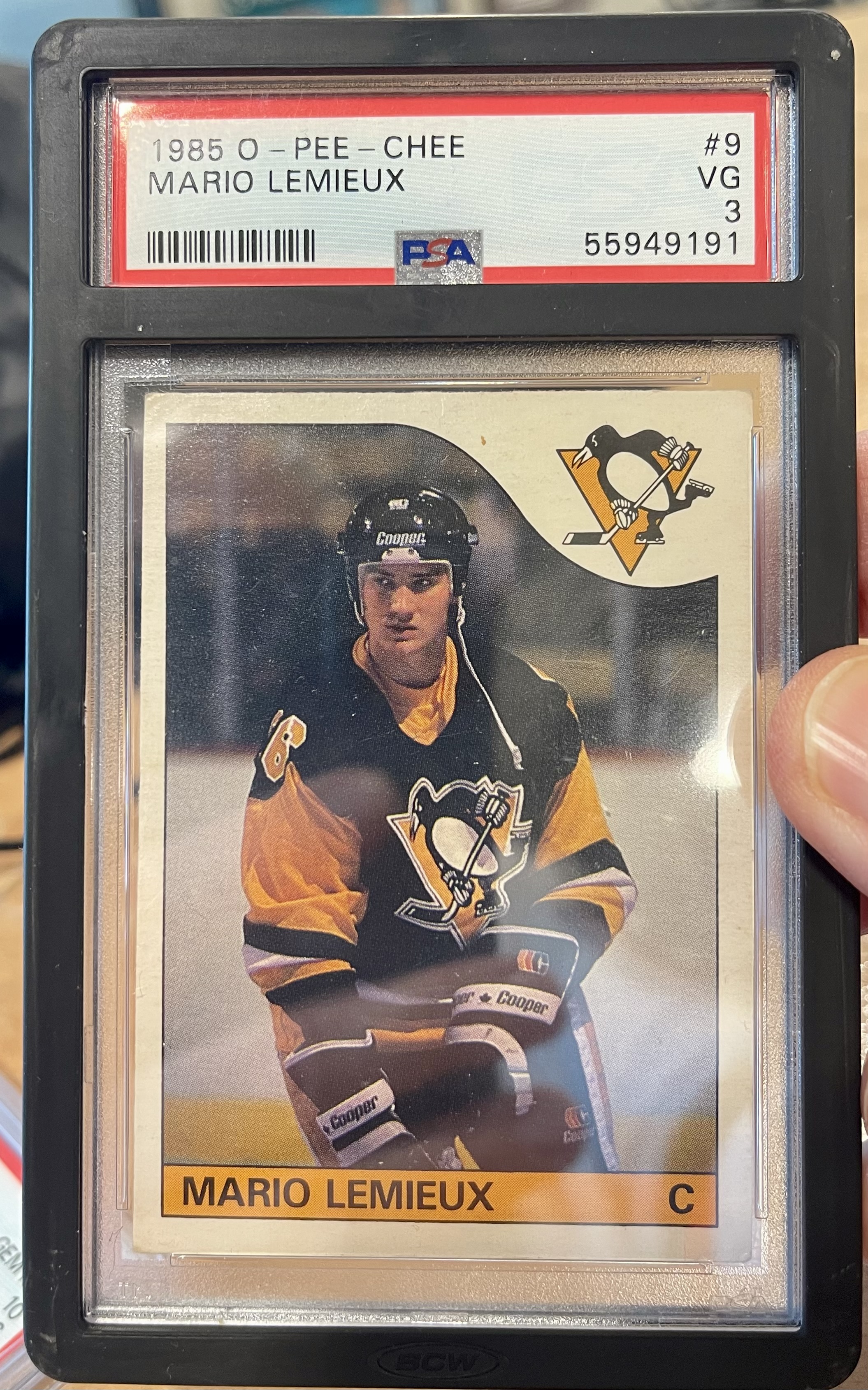

- 1986-87 Topps Mario Lemieux Rookie #100 PSA 8

Value: $150-$250

Why it’s a buy: Super Mario’s 690 goals and Penguins savior status shine here. This Topps debut (~1,500 PSA 8s) offers value vs. pricier OPC, with rising demand from Penguins Cup nostalgia.

Football (Focus: 1980s-1990s QBs and rushers with dynasty appeal)

- 1981 Topps Joe Montana Rookie #216 PSA 8

Value: $200-$350

Why it’s a buy: Montana’s 4 Super Bowls and 40,551 yards define ’80s QB excellence. This 49ers key (~900 PSA 8s) surges on dynasty revivals, a steal compared to his pricier Fleer version.

- 1989 Score Barry Sanders Rookie #257 PSA 9

Value: $250-$400

Why it’s a buy: Sanders’ 15,269 yards and elusiveness make him the ultimate RB. This Lions rookie (~1,200 PSA 9s) pops in the affordable Score set, with HOF scarcity boosting long-term holds.

Basketball (Focus: Bird/Magic rivals and ’90s big men with iconic designs)

- 1986-87 Fleer Larry Bird #3 PSA 8

Value: $150-$250

Why it’s a buy: Bird’s 3 MVPs and Celtics rivalry with Magic anchor this flagship set. Clean shooting iconography and low PSA 8 pop (~1,000) make it a ’80s staple for rivalry collectors.

- 1986-87 Fleer Magic Johnson #139 PSA 8

Value: $150-$250

Why it’s a buy: Magic’s 5 rings and 10,141 assists revolutionized the point guard. Paired with Bird in the set, this Lakers gem (~1,100 PSA 8s) trades on Showtime legacy and fast-break appeal.

- 1992-93 Topps Stadium Club Shaquille O’Neal Rookie #201 PSA 9

Value: $120-$200

Why it’s a buy: Shaq’s 4 rings and dunk dominance started here with Orlando. This premium rookie (~800 PSA 9s) captures Diesel’s rookie hype, undervalued vs. his pricier inserts but with Diesel-sized upside.

At shows, hunt raw NM examples from dealers with bulk ’80s/’90s lots—often 30-50% off online. Verify centering for grading; these balance nostalgia, scarcity, and performance for flips or displays.

Enjoy the hunt!